Get Started with Klarna Buy Now Pay Later: A Comprehensive Guide

Looking for a new way to shop that's both fun and smart? Then look no further than Klarna!

This Swedish-based company is all about making online shopping easier and more enjoyable for consumers. Whether you're a seasoned shopper or just starting out, Klarna is the perfect solution for anyone looking to simplify their shopping experience.

With Klarna, you can split your online purchases into four equal, interest-free payments made every two weeks. You can do this at checkout at one of Klarna's partner retailers or through the Klarna app, which is a shopping buddy that helps you keep track of your purchases, get exclusive deals and rewards, and more!

And the best part? No interest fees, provided you pay on time!

So, let's dive into the world of Klarna and see what all the buzz is about! With our top tips, you'll be shopping like a pro in no time.

Get ready to say goodbye to one-time payments and hello to effortless shopping and a clearer budget!

What is Klarna?

Klarna is a Swedish-based buy-now, pay-later (BNPL) provider founded in 2005 with the aim of making online shopping easier for consumers.

The company allows Kiwi shoppers over the age of 18 to split their online purchases into four equal, interest-free payments made every two weeks.

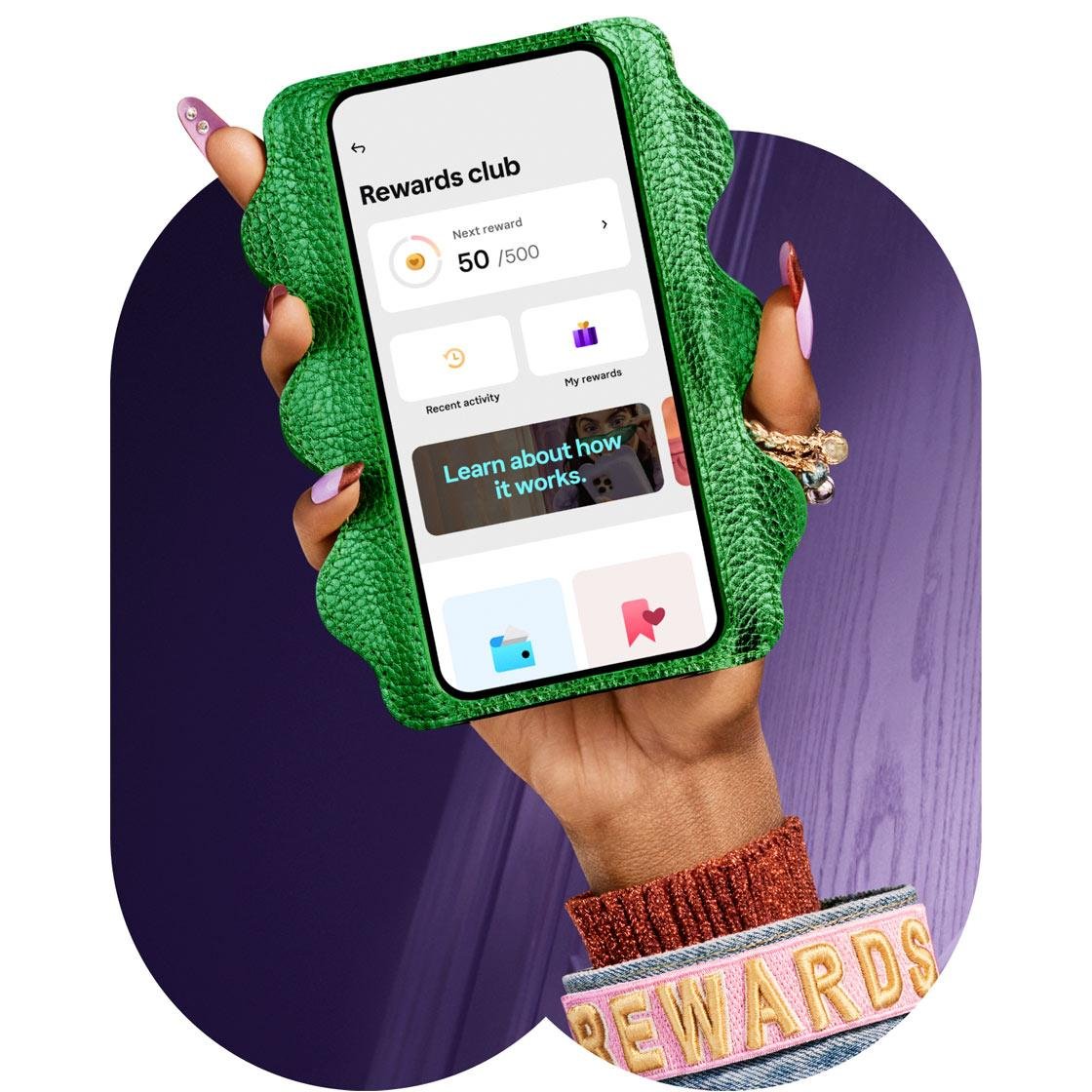

This can be done at checkout at one of Klarna's partner retailers or through the Klarna app, which also offers a variety of other features such as payment tracking, wish list creation, exclusive deals and rewards, and price drop notifications.

They’re unique in that unlike Afterpay, Laybuy and other BNPL providers, they let you create a ‘one time’ card that can be used at practically any online retailer. This removes the limitation of Klarna needing to have direct integration with e-commerce.

They also have a rewards programme, where you earn points, and can then redeem those for a range of digital gift cards. I have personally redeemed for quite a number of Mighty Ape gift cards thanks to Klarna!

Klarna sets customised limits for each shopper based on factors such as payment history, outstanding balance, shopping cart amount, and Klarna's ability to identify the shopper.

Late payment fees are limited to a total of $9 per order, and are dependent on the total purchase amount. These are the lowest fees among all BNPL providers in New Zealand.

Klarna does not perform a credit check when signing up or downloading the app but may perform one during a first-time purchase or after 365 days have passed since the last check.

What is the difference between BNPL and a credit card?

BNPL services like Klarna allow shoppers to pay off an item over several weeks without interest, while credit cards allow borrowing money from the card provider with interest charged on outstanding balances that are not paid in full at the end of each statement cycle.

With BNPL, shoppers can track repayments on individual items, while with credit cards, all purchases are lumped into one pool.

When BNPL and credit cards are used together, they can make for a powerful way of managing household cash flow, and also points and mileage earn.

How to start with Klarna

Getting started with Klarna is easy and straightforward. Here's a quick guide on how to start using Klarna for your online shopping:

Download the Klarna app: To start using Klarna, you'll need to download the Klarna app from the App Store or Google Play. The app is free to download and use.

Sign up for an account: Once you've downloaded the app, you'll need to create an account. This is a quick and simple process, and you'll need to provide some basic information, such as your name, email address, and date of birth. You could also create an account online in advance. This is all to help with verification and keep you and other shoppers safe.

Browse Klarna's partner retailers: The Klarna app features hundreds of partner retailers where you can use Klarna as a payment method at checkout. Browse the list of retailers and find one that you'd like to make a purchase from. If a partner isn’t present, you can search for the retailer website that you’re interested in and then opt to create a one-time card.

Add a payment method: To use Klarna, you'll need to add a payment method. This can be a credit or debit card.

Make a purchase: When you've found a product you'd like to purchase, select Klarna as your payment method at checkout. You'll then be able to split your purchase into four equal, interest-free payments made every two weeks. If Klarna isn’t available as a payment method direct with the retailer, you can use the app to create a one-time card to use with practically any online retailer.

Track your payments: You can use the Klarna app to track your payments, view your shopping history, and get help if you need it.

That's it! With these simple steps, you're ready to start using Klarna for your online shopping.

Why might I want to use Klarna?

Here are some reasons why you may want to consider using Klarna for your next purchase:

Pay in 4 instalments over 6 weeks with zero interest.

Shop with hundreds of partnered retailers or use the Klarna app to pay at any store online using a one-time card.

Manage all your payments, report returns, and get help if you need it through the Klarna app.

Get a clear overview of your shopping history, saved items, exclusive deals, and price drop notifications.

Choose from flexible payment options to fit your budget.

Never pay interest on your purchases, as long as you pay them off in time. They offer free payment extensions on the off chance that you need them.

Earn points for your purchases, and then redeem them on gift cards. Provided you are never paying late fees, you’re effectively making money from shopping as per normal.

What are some of the downfalls of BNPL products like Klarna?

Like with any product, there are potential pitfalls, and buy now pay later products like Klarna are not immune. Here are some reasons why using Klarna might not be for you:

Late fees: If a payment is missed, Klarna charges a late fee of up to $3 per instalment, with a maximum of $9 per order. Whether you are charged a late fee will depend on the total purchase amount.

Limited spending: Klarna sets customised limits based on your payment history, outstanding balance, shopping cart total, and its ability to identify you, which may limit the amount you can spend.

Credit check: Klarna performs a credit check when making your first purchase with a one-time card or choosing Klarna as a payment method at checkout, which may impact your credit score.

Repayment schedule: Repaying your purchases in four equal instalments every two weeks may not align with your personal financial situation and may lead to difficulty making payments.

Hidden costs: Some retailers may charge additional fees for using Klarna as a payment method, which may not be immediately apparent.

Lack of control: Using Klarna to make purchases may lead to overspending and a buildup of debt, as you are not required to pay for the item in full upfront. Never use Klarna of other buy now pay later providers if you cannot afford to buy the item now.

Limited retailer options: Not all retailers accept Klarna as a payment method, so you may not be able to use it for all of your shopping needs.

How to Avoid Late Fees with Klarna

Late fees can quickly add up and eat into the savings you get from using Klarna's interest-free payments. To avoid late fees and keep your shopping experience with Klarna worry-free, follow these tips:

Keep track of your due dates: Make sure to keep track of your payment due dates and make your payments on time. You can easily do this by using the Klarna app, which will send you reminders when a payment is due.

Set up automatic payments: To ensure that you never miss a payment, consider setting up automatic payments through the Klarna app. This way, you won't have to worry about making payments manually and can avoid late fees altogether.

Make use of Klarna's "Extend Due Date" option: If you need a few extra days to make a payment, Klarna offers an "Extend Due Date" option in its app. By using this option, you can avoid late fees and ensure that you're able to make your payments on time.

Stay within your spending limit: Klarna sets customised spending limits based on several factors, including your payment history with Klarna and the total amount in your shopping cart. Be mindful of your spending limit and avoid overspending, as this can result in late fees or damage to your credit score.

Make payments in full: To avoid late fees, make sure to pay your Klarna payments in full and on time. Late fees are limited to a total of $9 per order and can be extended through the Klarna app.

By following these tips, you can avoid late fees with Klarna and enjoy the benefits of their interest-free payments.

Remember, do not use apps like Klarna if you could not otherwise afford to purchase the product outright.

Remember, your goal is to stay on top of your payments and manage your cashflow, so stay mindful of your spending and due dates.

Our Top Klarna Tips

Here are our top five tips for using Klarna effectively:

Make use of Klarna's app-based management: Use the Klarna app to keep track of your payments, report returns (with Klarna-integrated retailers), and get help if you need it. By taking advantage of Klarna's app-based management, you'll have a clear overview of all your shopping with Klarna, which can help you keep better track of your spending.

Spread out your payments: By spreading out your payments over time, you'll be able to avoid having to pay for your purchases all at once. This can help you manage your cashflow and ensure that you don't overspend or go over budget.

Consider combining Klarna with a credit card: If you have a credit card that earns rewards points like Air New Zealand Airpoints, consider using Klarna to make your purchases and then spreading out your payments onto your credit card. This way, you can earn rewards on your purchases while also managing your cashflow.

Make use of Klarna's "Extend Due Date" option: If you need a few extra days to meet a repayment, Klarna offers an "Extend Due Date" option in its app. By using this option, you can avoid late fees and ensure that you're able to make your payments on time.

Stay within your spending limit: Klarna sets customised spending limits based on several factors, including your payment history with Klarna and the total amount in your shopping cart. Be mindful of your spending limit and avoid overspending, as this can result in late fees or damage to your credit score.

Summing Up

Klarna offers a smooth and safe way to get what you want today, without breaking the bank.

With its interest-free payments and app-based management, it among other BNPL providers is a great alternative (and addition) to a credit card and a perfect solution for those who prefer to spread the cost of their purchases.

Whether you're a seasoned shopper or just starting out, Klarna is a must-try for anyone looking to simplify their online shopping experience.

Just remember though, that while Klarna can be a great option for some, it may not be the best choice for everyone.

It's essential to weigh the benefits against the potential drawbacks, such as lack of control over your spending and potential late fees, before making a decision.

Never make a purchase using BNPL if you could not afford to buy the item in full today. The aim is to use BNPL to keep money in your bank account for longer, not to make purchases that you cannot afford.